Aren’t you tired of those oh-so-superior comments from the men-folk about how most women have no head for finances and are always dependent on the men to decode anything monetary? Well, here are 5 simple steps to show them that ladies can be totally money savvy.

1. Decipher the jargon: Bull and bear are animals, yes, but in the world of stocks and shares, they describe upward and downward market trends respectively. If you feel dizzy at the zillions of financial terms you encounter in a day, don’t panic. There are many reliable online tutorials to make you a financial whiz in days. You just need to keep working hard and follow the given instructions. Soon, you will be doling out gyan on equity, share capital, mutual funds and balance sheets.

Money wise – Check out sites like sharekhan.com and sharemarketbasics.com to increase your knowledge of all things stock market.

2. Assess financial health: Once you have mastered the macro terms you have to turn your attention to your personal finances. To spend and save prudently, you need to be aware of your total income and savings. If you are salaried and earning your money only from one source, computing your inflow is easy. If, however, your money comes in from multiple sources then you will have to maintain a worksheet or a journal and fill in the relevant details. Keep updating the sheet regularly to know your financial position at a glance.

Money wise – If you are feeling all at sea about grouping your income details, seek the help of an expert to make the skeletal framework of the central document where you will maintain particulars about your cash flow. Request him to keep it simple so that you can easily input data and micro manage your assets.

3. Organise your finances: Do you end up spending more than you intended to every month and then regret it? Well, the solution lies in organising yourself. There is nothing better to boost your sense of responsibility than the thought of handling other people’s money. Just imagine the cash you are handling is not yours but your friend’s. That will immediately make you much more careful with the money. Prepare a budget and try not to deviate from the set pattern. Always set aside a fixed amount for unforeseen emergencies.

Money wise – Invest in a harmonium file and label each flap according to expense heads. Sort out the money needed for routine, monthly expenses and stash them in their respective labelled sections in the file.

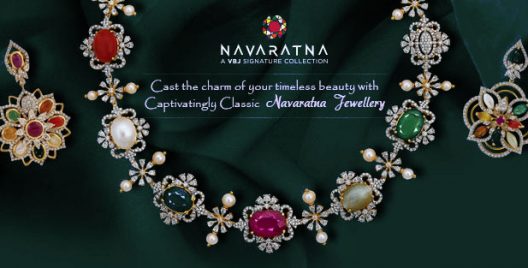

4. Spend smart: Make a list of what you want to spend on in a particular month and how you intend to finance the same: cash or plastic. Categorise the potential purchases as essentials, comforts and luxury. Set aside money for buying the necessities. There can be no compromise or cutback in that area. Just scour around to see if you can find a store where you get to buy quality stuff at economical rates. Next, see how many of the comforts you want to buy this month and how many you can push to the next. As for luxuries, give it a deep thought before spending on them. Of course, you need to indulge yourself once in a while but make sure you are adequately cushioned to deal with the huge dent that buying the emerald ring which-peeps-at-you-with-loving-eyes-from-the-shop-window will cause in your pocket.

Money wise – If possible, avoid purchasing greengroceries from air conditioned supermarkets and malls. Visit the Sunday local bazaar instead. Not only will you save a lot of money, you will get fresh, home grown vegetables and fruits.

5. Be a super saver: Savings are as important as earning and spending because you need to be prepared for a rainy day. Before investing do some research and find out which is the safest option to secure maximum returns on your money. Whatever your savings portfolio looks like you have to keep a regular check on the same like keeping track of maturity dates and interest rates. In the beginning, it will seem cumbersome but once you get the hang of it, it will be a piece of cake. Plan ahead and watch your money grow.

Money wise: Don’t put all your eggs in one basket. Diversify and distribute the money here and there: for instance, partly in gold, partly in mutual funds, some in fixed deposit etc. Investing in real estate is also a smart option.